You’ve landed top-tier talent and they’ve helped grow your business. Now it’s time to reward their efforts. When it comes to bonus vs raise, which is best for your business?

The truth is, recognition is nice, but money talks. The key is ensuring that your team is properly compensated for their hard work without bottoming out your bottom line.

Let’s talk pros, cons and options.

Free: Quickstart Guide to Digital Payments

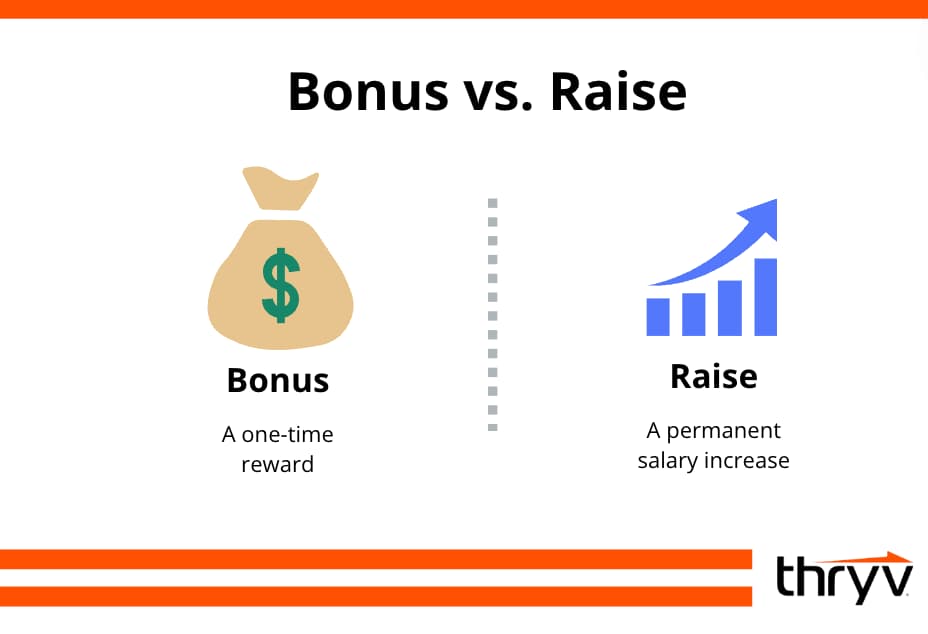

Save NowBonus vs. Raise

A bonus is a one-time award for an employee, while a raise is a permanent increase in their salary. Bonuses are typically awarded for short-term performance, while raises reflect a long-term investment in an employee.

Both raises and bonuses are valuable for small business owners. They each have their place in employee development and satisfaction. Let’s explore each in more detail in the section below.

Raises

When people mention a raise, they’re referring to a performance increase. These are increases given based on whether individuals met their goals for the year.

For your employees, this raise means they can finally keep up with the cost of living. They’re able to better budget monthly expenses and plan for the unexpected.

However, as the owner, you may look at this as a permanent increase in cash-out flow. Technically, it is.

But rather than look at this as a larger financial commitment, consider it an investment for your company. Providing raises within your company:

- Boosts employee morale

- Increases motivation

- Improves employee retention

- Ensures long-time employees are rewarded

Increase Options

When providing raises, there are several routes you can take. Your company may want to give an across-the-board raise where each employee receives the same flat amount.

Another option could be a determined percentage based on the employee’s current pay. This route may require a bit more financial planning.

Because payroll is usually the largest expense for businesses, you’ll want to sit down with an accountant to determine which works best for the amount of revenue and monthly cash flow your business generates.

If your books are not in order, check to see if your CRM has an integration to streamline your money management process. This will make identifying financial opportunities clearer.

Do companies have to give raises every year?

No, but raises are a great way to invest in an employee’s long-term growth. For example, in some cases, it may be cheaper to give an employee a raise than to hire a new team member — especially if your existing employee can do the job at hand.

Additionally, raises keep employees happy and help you retain high-value team members. It’s tougher for an employee to walk away from your business if they know a raise is coming.

In some cases, however, you may not have the resources available to give an employee a raise. In this case, a bonus may be a better solution.

The Quickstart Guide

to Digital Payments

Find everything you need to know about collecting payments, processing payments, late payments, and more in this free resource.

Bonuses

If you begin crunching numbers and find that your business cannot support a permanent increase in payroll expenses, your best bet is to look to bonuses.

Because bonuses are not a reoccurring expense, it’s more financially feasible for businesses while providing much of the same benefits as raises.

Keep in mind that less is not more here. Avoid skimping on bonuses too much as it can damage staff morale if they feel like they’re being thrown pennies for their hard work to keep your business afloat.

Financial Bonus Options

By far, cash is the most popular bonus option you can offer. Maybe an employee is needing to purchase a new car, add to their home-savings fund, or plan for a major life event — think how helpful and appreciated a cash bonus would be.

When it comes to bonuses, some businesses tend to wait until the end of the year. This is for consistency, but also to allow time to ensure it’s a wise financial move for the company.

To determine the amount of the cash bonus, you can use one of two methods:

- Defined bonus payments where employees know how much to expect at the end of the year as long as they meet certain objectives based on their job responsibilities and company revenue thresholds.

- Discretionary bonus payments, which are awarded without being linked to a performance plan. This gives you more flexibility but can cause problems if your employees discuss their bonuses and find that not everyone was rewarded equally.

Secondary Bonus Options

While cash is likely the preferred form of a bonus, there are other forms that may be worth considering.

Gift cards that spend like cash will be popular with your staff, but cards from restaurant chains or stores that provide multiple spending options can also make a good bonus.

When purchasing high quantities of gift cards, always inquire as to whether there are any discounts available.

Food is another option. The “Christmas ham” is a good example of a once-appropriate food bonus. These days, businesses treat their employees to a holiday meal rather than sending them home with a piece of meat.

If you are planning to give the gift of food as an employee bonus, make sure to consider:

- Cultural or religious dietary restrictions

- Employees who are vegan or vegetarian

- Food allergies

Annual Bonus Percentage for Employees

Last year, small businesses that used Gusto for their payroll gave out bonuses of anywhere between 3.8% to 36.2%. The average bonus was $2,145, which was 21% lower than December of the previous year.

Is it better to get a bonus or a salary increase?

When it comes to bonuses and raises, employees are happy with either; however, the two are not created equal — especially for business owners.

It’s important to consider the impact bonuses and raises will have on a company’s profit margins. Financially over-extending can cost you the success of the business.

But here’s another hard truth: Holding out on bonuses and raises is just as damaging.

Because your employees fuel your business, rewarding them properly is critical to success — and retention.

Consider providing a bonus or raise for:

- Exceeding expectations. Employees who go above and beyond directly contribute to your success. They’re the ones taking on new tasks while seeking out ways to improve and grow the business.

- Loyalty. Those employees who have stayed with your business for 5, 10 or 15 years are committed to you and your dream. Rewarding their commitment is a great way to avoid them leaving you for higher-paying competition.

- Team performance. If certain teams within your company crush their goals, this is a great time to redistribute that success.

- Cost-of-living. Inflation happens and it’s your duty to help those who help your business. Providing either a bonus or a raise will help employees maintain their quality of life.

Bonus vs. Raise: Choosing the Right One

Your employees are an important part of your business’s recipe for success. Be sure to keep a steady cash flow throughout the year so you can share your thanks through bonuses or raises.

If you’re having trouble deciding bonus vs. raise — here’s a good rule of thumb: give out bonuses as short-term rewards while raises should show employees you believe in your long-term partnership with them.

The Quickstart Guide

to Digital Payments

Find everything you need to know about collecting payments, processing payments, late payments, and more in this free resource.