Here’s a challenge: Think about the businesses that your personal life is deeply connected to. I’ll start: Your bank. Your internet provider. Your wireless service. Now, imagine if one of those businesses suddenly went belly up one day. Hugely disruptive and devastating, right?

Over time, you’ve learned that you don’t leave your banking to a fly-by-night financial unknown, and you would feel pretty dubious about a $39-for-life cell phone plan, wouldn’t you?

Now, apply that same scenario to the software provider you use to run your business. Is the damage the same? It has the potential to be. Let’s dive in.

The Low-Risk, High-Maintenance Option

Most small businesses know that they need some form of software as a service (SaaS) to run their business. Maybe it’s just a single-point software solution, such as an email service or a payments provider.

With minimal bells and whistles, you can download a cheap email marketing platform and send a few emails. If you don’t like it, or that software provider disappears or gets gobbled up by a larger tech firm, it’s inconvenient maybe, but not too destructive to your business.

But a payment processor hits closer to the money, so it has a bigger impact. Ultimately, however, you could switch to another payments processor without too much damage.

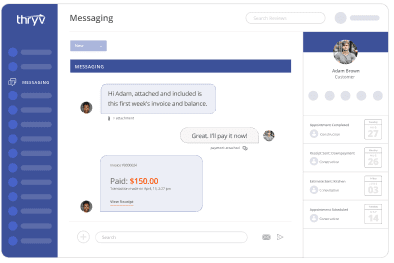

Now, add a single-point solution to everything else you need to run your business – CRM, document storage, appointment scheduling, multiple inboxes, online listings, reviews … that’s a lot to manage.

And if any of those software businesses were to go under, it’s a mountain of clean-up, because they contain important client information and your customers interact with them daily.

When SaaS Businesses Fail

I’m not speaking hypothetically here. In the first three years of business, an estimated 92% of SaaS companies fail, regardless of growth or funding. Maybe they didn’t understand the marketplace needs, folded under competitive pressure or couldn’t nail the engineering.

Has anyone heard from Skype since Microsoft bought it in 2011? Hopefully, you weren’t one of those folks scrambling to grab your data when Nirvanix quickly shuttered in 2013. Katerra filed Chapter 11 this summer over mismanagement and lenders that started dropping like flies.

So, what if your important company data is in that 92% of failed SaaS? You could lose your contact information, your payment history, your conversations, sensitive documents and … yikes. You could lose a lot of business and it would be time to start over.

With 99% of businesses using one or more SaaS solutions, and swapping out 30% of those apps every year, well, that’s a lot of stops and starts, to say the least.

As business owners become increasingly tech savvy, they realize they need a full solution to run their business. But that means you’re putting more eggs into that one SaaS basket.

And these businesses see the opportunity before them. The SaaS market targeted to small business is forecasted to grow up to $30.5 billion this year. So, you know what that means: Here comes the grift.

To be clear, there are several SaaS organizations on the market who care deeply about helping businesses succeed (psst … we’re one of them). But there are plenty who are here just for fast cash, and who really don’t care where your business is six months from now.

Here are the warning signs and what to look out for:

Be Wary if it’s Too Good to be True

If it’s a 75%-off deal, that should be a red flag. If they’re essentially giving away the software, how is the company going to be sustainable over time? They have two scenarios: Run out of money and close their doors, or raise their prices on you to cover their growth – the bait-and-switch.

Chances are, they are running this deal in order to grow their customer base and will do anything to build that list. If you worked for a roofing company, and your only job was to book roofing jobs, regardless of what the outcome was, you could book roofing jobs for $2,000, right?

Sure, you’d get a lot of jobs, but you wouldn’t be able to deliver the service.

Watch Out for Exorbitant Up-front Onboarding Fees

Read the fine print. While that introductory incentive is super low, you may end up having to pay thousands of dollars in tech support. Again, the strategy is to collect as much short-term cash as possible to fuel the machine that’s simply racking up customers.

Once they’ve got your onboarding fee, they don’t care if you leave or not, or if your business is successful or not.

Consider: How Transparent Is the Software Provider?

There are some significant benefits for the customers of public companies. Namely: Transparency. If there’s a problem, the stock market will reveal it.

Is there something fundamentally wrong with the company’s pricing model, user engagement or customer churn? Those are things that will bring a business down, and stockholders and analysts will suss it out.

With a venture-backed, private company nothing needs to be disclosed. Are they losing tons of cash? Who knows? Is more funding coming? You’ll never find out. Can they afford the engineering costs to bring new functionality to the product? It’s anyone’s guess.

Public companies will make the effort to publicize functionality evolution and product improvements. They look to build long-term, sustainable success, develop actual relationships with customers and continue making the product better by deeply listening to user feedback.

The software empowers you to control your business, not run it for you. The goal is to help you be more effective.

Say No to One-time Payments

If you see “Activate a lifetime license for just $39” … don’t walk, RUN the other way.

A growing number of software programs offer indefinite access for a one-time payment. And if that’s the case, how are they paying their staff? Who’s hosting their software? How will you get support?

Read between the lines, and it becomes increasingly clear that this is simply a cash grab. They are just trying to get an influx of cash so they can run their next scheme.

Take a close look at the company’s website and social media – are there images of the actual software, or is it slick motivational coaches they’re trying to sell you, as well? Click on things like the “terms and conditions” and take a peek at the URL. Are you even dealing with the same company, or is another company selling the same product under different names?

When you’re entrusting your business – your livelihood – to a software provider, choose for the long-term, not a flash-in-the-pan. When they go down and leave you in the dust, think about the disruption to your business, the lost data, the time it will take to retrain your team.

We can all appreciate a good deal from time to time, but always ask: What’s the ultimate value? To build your business over time, choose a partner with a sustainable plan and whose success is dependent and fueled by your success. Choose a partner who takes their business as seriously as you take yours.