So you want to start a small business. But like many of our clients, you have 101 ideas about how to start a small business or what you need to do first.

The most intimidating part of building your business is just that – getting started. Here are 5 things you need to do to get your new small business up and running.

1. A Tangible Business Plan

According to Huffington Post, writing down your goals can make you 42% more likely to achieve them. Not only that, but writing down your vision for your business can also help you get any financing you need. The U.S. Small Business Administration (SBA) offers pages and pages of guidance for putting together your business plan. Get a business plan template here.

According to SBA, a traditional business plan includes (at least):

- Executive summary: This is where you’d put your mission, vision and goals.

- Company description: What problem will your business solve? What’s your niche? What makes you different?

- Market analysis: What makes competitors successful? Who is your target customer?

- Organization and management: How will you incorporate your business legally? Who will run your company? How many employees do you anticipate having?

- Core products and services: What do you intend to sell? Describe the product or service lifecycle. Do you need any patents?

- Sales and marketing approach: More on this in a sec.

- Funding request: Explain in as much detail as possible how much money you need to get up and running, and how long the start-up funds will last your business.

- Financial projection: Estimate, based on your research and funding needs, five years of financials.

Whether you’re planning to start a small business, or you have gotten started and need to apply for additional financing, having a business plan in your back pocket will accelerate your growth and success.

2. A Business Bank Account

Your business plan should have given you an idea of the money you’ll need to raise to get started as well as a monthly budget and predicted expenses. One of the worst things you can do is begin using your personal bank account to manage the finances of your new business. Doing so will give you too much leeway to mix your personal and business funds, and it could even make things complicated when it comes to tax time.

Go open a new bank account dedicated to your business. Many banks even offer incentives and promotions for small business accounts, so ask about those before you choose a bank.

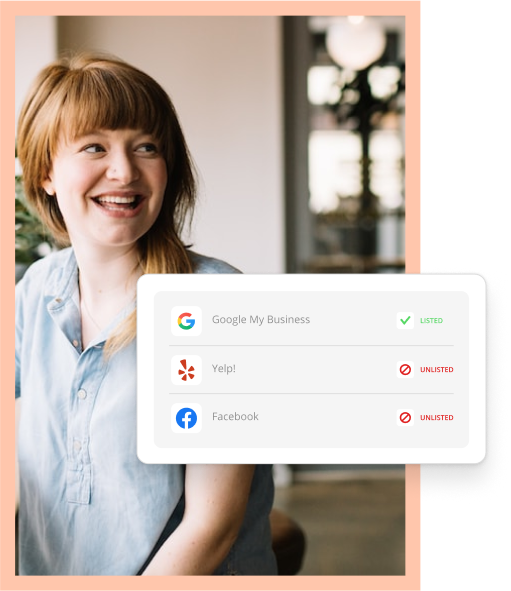

3. A Startup Marketing Plan

When it comes to marketing, one of the biggest potential downfalls you face is trying to do too much too soon. Instead, when you start a small business, choose 3 to 4 reasonably priced, realistic marketing channels you think will best help you build up your client list. Then, later down the road, you can focus more on nurturing and retaining customers with more advanced marketing tactics like text and email marketing.

Ideal startup marketing tactics:

- Physical signage and storefront branding

- Hard-copy flyers, brochures and business cards

- A business website

- Social media advertising (like simple Facebook ads where you can set a maximum budget)

- Search engine marketing (Google AdWords, for example, to drive traffic to your website)

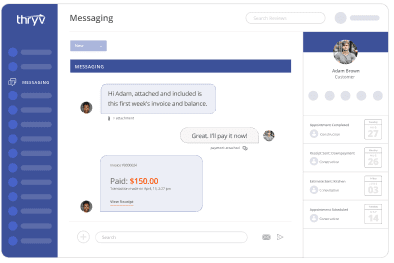

4. A Place to Store Customer Data

Whether you call it a CRM (customer relationship management) system or not, you’ll need a reliable place to store contact information and special notes about your customers and clients. More than a place to store client data, a quality CRM tool can help you manage your business in other ways.

Surprising ways a CRM will benefit your business:

- Manage your team’s activity.

- Better define your target customer.

- Improve customer satisfaction.

- Boost customer retention.

- Make communicating with contacts much easier.

- Spot market trends.

- Test new marketing tactics.

- Improve data security and increase customer confidence.

Not sure which CRM to trust? Here are 9 features you should look for in a CRM.

5. A Network of Partners You Trust

We’ve talked before about the importance of networking to build awareness and support in your local community when you start a small business. Making friends where it counts can really help your business attract new customers, collaborate with local lawmakers and Chambers of Commerce, and cross-promote with other businesses.

Don’t stop networking once you’ve become connected locally. Get acquainted with national resource groups and small business associations so you stay on top of wider trends and advancements for all things “small business.”

We mentioned the SBA earlier. That’s because Thryv partners with national small business associations like SBA and SCORE to support local business.

In fact, we’re co-sponsoring a free virtual conference as part of the National Small Business Week, happening May 1 – 3, 2018.

Here’s what SBA Administrator Linda McMahon had to say about the event.

“…Whether they are starting up, expanding or getting through a tough time, the SBA is the nation’s only go-to resource for small business backed by the strength and resources of the federal government.

It powers the American Dream. And the SBA is working to make that dream accessible to more Americans by modernizing its application processes, improving online resources, and streamlining how technology is used to deliver services more efficiently and effectively.”

To access free business management, marketing advice and more, check out the upcoming virtual conference. And don’t forget to stop by Thryv’s booth and say, “Hi!”