If your accounting business is seeing a steady drop in bookings over the past few months, then competitors likely are outplaying you.

Modern small businesses have a lot of things to consider when it comes to out-marketing their competition. However, it doesn’t have to be complicated.

In fact, we’ve narrowed down four of the most likely reasons you’re losing customers to other firms. And knowing where the problems lie gives you a better chance at fixing them successfully.

Once you understand the issues, you’ll be able to address them in your own business. Then customers should flock to your practice once again.

Free Guide: The Modern Small Business Playbook

DownloadReason #1: They’re Doing SEO Better Than You

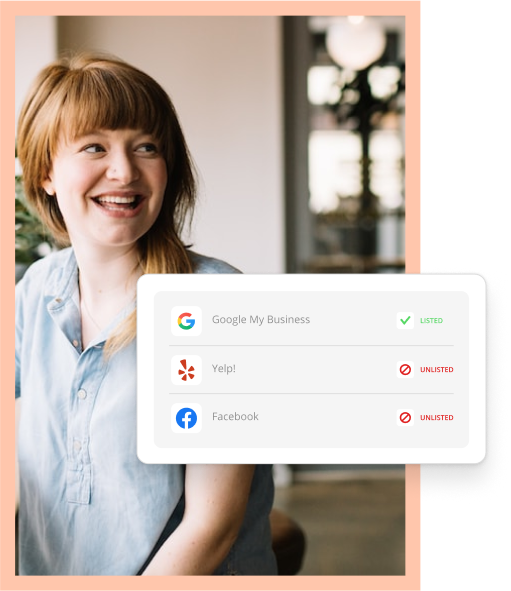

For small businesses, search engines are the easiest way for customers to find you and get in touch. Accounting businesses that do search engine optimization (SEO) well — such as optimizing their websites — will be at the top of the list and ahead of the competition when customers use search engines like Google and Bing to find them.

The first step to optimizing SEO? Look at your website. Most websites are built (or more specifically, written) with SEO in mind, and if yours wasn’t, you should take a look at updating it.

To ensure your website comes up first on search engine listings, think about how your customers search for your business. They’re more likely to search for “tax accountants in my area” than “accounting business.” Ensuring your pages are optimized for that kind of language is crucial.

Search engines also love things like blogs or news articles, so having a good content strategy that addresses current events means you’ll be getting preferential treatment.

Lastly, there’s also SEM — that’s search engine marketing. This is about paying for ads that come up right at the top of search engine results pages. These are also a great way to elevate your business, but they can become expensive if a lot of competitors are jockeying for the same thing.

Reason #2: They’ve Set Up Automated Reminders

What do automated reminders have to do with losing customers?

A lot!

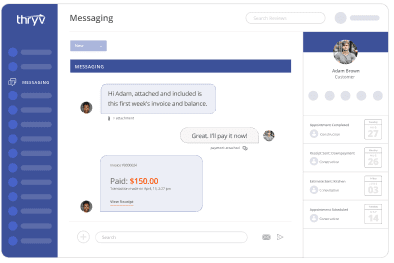

If your competitor is sending automatic reminders about upcoming appointments, then they’ve got a major advantage on you already: An open line of communication. Sending a special offer or reminder via text can become part of that ongoing dialogue.

That means even if your SEO was perfect, they’ve still got the advantage of being seen first, especially since texting is a top form of communication for most people.

Sending text reminders not only helps your bottom line by reducing no-shows, but it helps improve brand recall.

That means when talking to friends or family about tax accountants, your accounting business is more likely to come to mind. That’s greater marketing word-of-mouth for you!

Automation is important here, too: It means you’re not having to send these messages out yourself, and instead can focus on running your business. You won’t have to worry if you’ve sent someone their 24-hour submission deadline reminder.

Customers are 12 times more likely to trust an online review than anything else on your website.

—eConsultancy.com

Reason #3: They Have a Robust Review System

Online reviews are critical for small business. In fact, customers are 12 times more likely to trust an online review than anything else on your website.

Having a lot of reviews gives your accounting business credibility. Even negative reviews. Potential customers searching for a business will be more likely to choose one with a lot of reviews than just a few.

This is an important part of your sales cycle. Ensure you’re asking for feedback from customers as much as possible — even if they may not have had a great experience with your business.

When you receive negative feedback in a review, be sure to respond to the review and offer solutions to right any wrongs.

No business is perfect, and your customers will feel like they are being listened to. Keep in mind: Potential customers will see this interaction, too. So, put your best foot forward, even if you’re in repair mode.

Reason #4: They Allow Multiple Payment Options

Providing multiple ways to pay for your services is expected now. People want to be able to pay in a way that suits their financial processes, not yours.

If your accounting business has only allowed bank transfer or credit cards as the sole forms of payment, you may be losing customers to your competitors.

Allowing customers to pay you in person and online — say, via ThryvPay — will help them feel like you’re flexible to their needs, and catering to them specifically.

Much like automated reminders, they’ll be more likely to recommend your business to family and friends when it comes up.

And make sure you plaster this all over your website. Showing all the possible payment options you offer will help ensure that whoever lands on your website stays on it, and doesn’t run off to another competitor.

Watch the video below to learn more about how ThryvPay works for businesses like yours.

Modern Small

Business Playbook

Find expert tips and tools to help you streamline communications, automate your marketing efforts, improve your business operations, and more in this free guide.