The payment processing world has a dirty little secret. It’s called CNP. And it’s used in the context of CNP transactions, a prevalent source of concern in the world of payment processing.

Like many 3-letter acronyms, CNP can be intimidating, frustrating and even demotivating for owners of local businesses. But it doesn’t have to be.

Free: Quickstart Guide to Digital Payments

Save a CopyCNP Meaning

CNP transactions take place when you attempt to process a debit or credit card for payment without having the card on hand. Sound out-of-the-ordinary? It’s not at all.

CNP transactions are incredibly common. They occur when someone places an order or pays for services rendered online, by mail or fax, and even by phone. Recurring payments can also be considered CNP transactions.

Examples of Card Not Present Transactions

- Online Payments

- Phone Payments

- SMS Payments

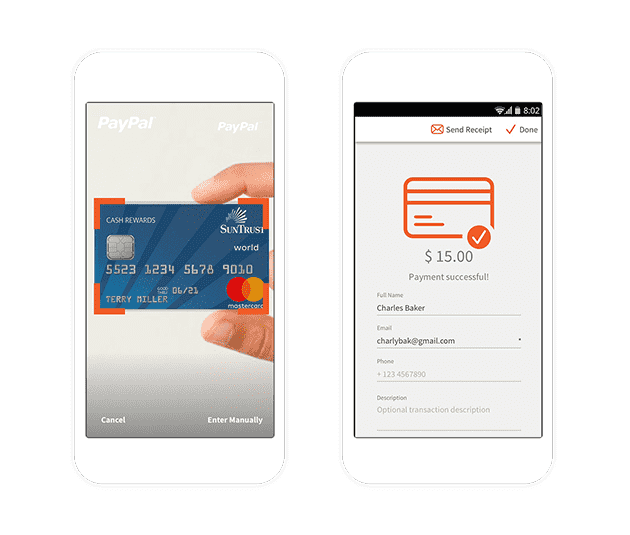

- Venmo, PayPal, Zelle

While CNP transactions aren’t impossible, they have common risks and frustrations associated with them. So handling them well, and doing so without breaking the bank, is easier said than done.

As a local business owner, your priority is getting paid. And while having the card in front of you would make that easier, you certainly don’t want to have to turn customers away if that’s not the case. Here’s everything you need to know when it comes to CNP transactions.

Why CNP Transactions Are So Tricky

If you’ve got a credit card number and permission to run it, you should be able to charge someone for work you’ve completed, right? Unfortunately, it’s not that simple. In situations where both the business owner and customer can’t be present to complete a transaction, the potential for fraud increases.

The impact of CNP fraud:

- In 2014, CNP transactions made up 45% of U.S. credit card fraud.

- A 2016 report by Aite Group forecasts that by 2020, online fraud will grow to $7.2 billion dollars.

- Visa estimates online and card not present fraud to be about 7 times as frequent as card present fraud.

CNP transactions also make up a majority of the transactions that result in chargebacks. Chargebacks occur when an individual disputes a charge to their card with the card issuer (a Visa or Mastercard, for example), asking them to reverse and remove it. They’re meant to protect consumers from fraud. Ultimately, though, the card issuer withholds funds until they come to a decision on whether or not the charge was valid — a time-consuming and frustrating process that often favors consumers over business owners.

Card Not Present Transaction Fees

Fraud and chargebacks impact your revenue. In the case of either, chances are you’ve already rendered services or delivered a product, and you’re no longer going to get paid. You may even get slapped with a hefty fee. (Ouch!)

To protect consumers and businesses from these situations, most payment processors charge higher fees for CNP transactions. Popular payment processing companies like PayPal Here, Square, and Intuit (QuickBooks) GoPayment all accept CNP transactions, but the associated fees are often much higher than those for a typical transaction.

How to Do a Card Not Present Transaction

You’re probably thinking, “All I hear is ‘fraud and fees’. Why would I want to accept CNP transactions at all?” Fair question. But the answer is simple — if you don’t accept them, your customers will find someone who does.

They key is to know the best practices for protecting yourself against the potential fraud and hefty fees associated with CNP transactions. Here’s our best advice.

- Gather more information from customers when a card isn’t present. You might typically require a name, address, card number and zip code. Consider also requesting:

- Bank account number

- Expiration date

- A 3-4 digit security code, typically on the back of the card

- Keep detailed records of each transaction, including:

- Date

- Time

- Exact products or services purchased

- Retain copies of all order forms, estimates, invoices, receipts and shipping confirmations.

By keeping solid records of the information above, you’ll be much better protected against any of the negative repercussions CNP transactions can cause.

Our Best Tip Yet

Does handling the intricacies of card not present transactions alone sound intimidating?

Contactless Payments Are Here to Stay

We surveyed 2,000+ consumers, and here's how they want to pay small businesses.