-

Products

Marketing

- Enhanced Local ListingsManage 40+ online listings

- Reputation ManagementImprove your online reputation

- Social Media ManagementGrow your social following

- Website BuilderBuild a professional website

Sales

- Scheduling & AppointmentsManage your bookings

- CRMKeep customer data organized

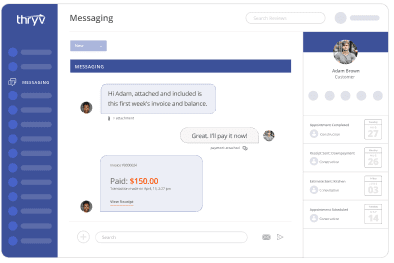

- InvoicesGet paid faster

- Pipeline ManagementTrack deals from start to finish

Automation

- Marketing AutomationStreamline your marketing efforts

- Automated ReviewsGenerate more customer reviews

- Automated PaymentsProcess payments seamlessly

- AI Powered SolutionsImprove efficiency and save time

Add-ons

- SEO ManagementRank higher in search results

- Thryv LeadsIncrease leads to boost sales

- Growth PackageIncrease reach in new cities

- Workforce CenterRun payroll & automate tax filings

-

Industries

Featured Industries

Home Services

Health & Wellness

Legal Services

-

Resources

Blogs & Content

Free Tools

Learn Thryv

Help & Support

-

Why Thryv

#1 Small Business Software

See why business owners choose Thryv over any other software.

#1 Small Business SoftwareLearn MoreOnboarding & Support

Experience our unmatched, onboarding and support team.

Onboarding & SupportLearn MoreCustomer Reviews

Don’t take our word for it, see what our users say about Thryv.

Customer ReviewsLearn MoreCompare Thryv

We work with the softwares that you love.

Compare ThryvLearn More

-

Marketing

- Enhanced Local ListingsManage 40+ online listings

- Reputation ManagementImprove your online reputation

- Social Media ManagementGrow your social following

- Website BuilderBuild a professional website

Sales

- Scheduling & AppointmentsManage your bookings

- CRMKeep customer data organized

- InvoicesGet paid faster

- Pipeline ManagementTrack deals from start to finish

Automation

- Marketing AutomationStreamline your marketing efforts

- Automated ReviewsGenerate more customer reviews

- Automated PaymentsProcess payments seamlessly

- AI Powered SolutionsImprove efficiency and save time

Add-ons

- SEO ManagementRank higher in search results

- Thryv LeadsIncrease leads to boost sales

- Growth PackageIncrease reach in new cities

- Workforce CenterRun payroll & automate tax filings

- Pricing

-

Featured Industries

Home Services

Health & Wellness

Legal Services

-

Blogs & Content

Free Tools

Learn Thryv

Help & Support

-

#1 Small Business Software

See why business owners choose Thryv over any other software.

#1 Small Business SoftwareLearn MoreOnboarding & Support

Experience our unmatched, onboarding and support team.

Onboarding & SupportLearn MoreCustomer Reviews

Don’t take our word for it, see what our users say about Thryv.

Customer ReviewsLearn MoreCompare Thryv

We work with the softwares that you love.

Compare ThryvLearn More

- Partners